Figure can also be grant their HELOC application as fast as 5 days off software. Financing refinancing may take between 20 months and you may four weeks so you’re able to feel canned. This is certainly maybe one of many quickest financing you can get in the united states.

Fair Interest

One would features think the company might have composed to possess the effortless app and you will quick disbursement that have a substantial interest rate. Yet not, Figure still also offers one of the most competitive rates of interest up to. The organization have an annual percentage rate rate ranging from 3.5%, as the HELOC rates was currently cuatro.61%. Remarkably, consumers having borrowing from the bank relationship subscription or automobile-spend can take advantage of discounts ultimately causing less APRs.

Fewer Fees

One of the challenges consumers face are using more fees while you are upkeep a loan. Shape loan lenders simply charge a fee 4.99% of your own 1st draw count while the origination charges. Except that that it, you don’t need to be concerned about expenses such as for instance assessment costs, later charges, yearly charge, and prepayment costs. As a result, it gets better to agree to paying up your loan.

Softer Credit check Only

It is fascinating observe Contour asking for permission to take care of simply soft borrowing from the bank inspections. Biggest loan providers does not qualify you for an individual interest until they create a hard borrowing from the bank pull on your credit score. Individuals having a minimum credit rating out-of 620 is be eligible for HELOC for the system.

Changed Mark Maximum

Contour now offers a flexible HELOC which enables one mark towards the credit line. Even with coughing up your loan, you could potentially nevertheless draft so you can one hundred% of the unique amount. So it render was an improvement into organization’s initially mark out-of 20%. So it attribute tends to make Contour a far greater alternative with regards to HELOC.

Figure Disadvantages

You’ll find always a couple of sides to a coin. It could be wise to suggest the brand new inadequacies regarding Contour, that i are finding. Here are the downsides off Figure;

Possessions Choices

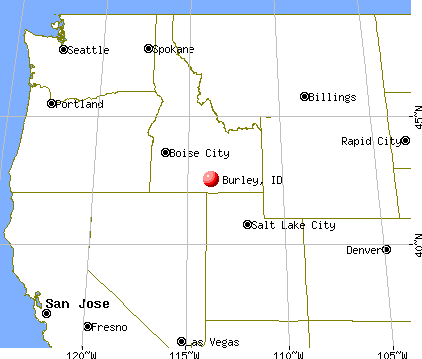

Shape is extremely choosy off characteristics which can be eligible for the latest Shape family collateral line of credit. It availableloan.net i need money right now has been spelled aside that the acceptable qualities is solitary-family unit members houses, townhomes, and regularly apartments. Some other functions instance multifamily home, commercially zoned a house, co-ops, houseboats, and you can are formulated houses commonly entitled to get Figure’s HELOC. At the same time, certain lenders get imagine borrowers that have such as for instance qualities.

Reduced HELOC Mortgage Cap

Significant family equity credit lines provide that loan cap from $five hundred,000 and past. At exactly the same time, Contour HELOC keeps a loan cap of $eight hundred,000. That it low cap might possibly be a you will need to do away with their chance just like the both the software in addition to resource procedure was on the internet. Almost any factors they’ve got because of it, the truth is its a regulation on the borrower.

Restricted Support service

Customer support is but one aspect of team you to definitely automation and you can AI may well not perform effortlessly at least for a time. And that, Profile features fallen brief in this regard. It doesn’t matter what urgent you might have to correspond with a beneficial support representative, you might have to watch for days to get a reply regarding the support cluster. There are no mortgage agents to talk to otherwise inquire regarding the mortgage. I have found the brand new live speak element is extremely minimal and will perhaps not promote high enough responses.

Services Offered by Shape

I wish to accept that you may have a look out of exactly what Profile does by now. But not, I do want to elevates from information on the characteristics provided by the business. You won’t want to assume the service made is the identical just like the compared to most other borrowers you may wish to believe. Very within the next section, there is certainly me personally detailing all these characteristics and just how Shape functions.