You could get on your lender’s site, get into your own biller’s details and you can agenda payments in minutes right from your financial membership. If you would like clarify something further, you could potentially schedule recurring ACH money for the monthly payments. The newest ACH circle is discover to own https://vogueplay.com/ca/koi-princess/ commission control for over 23 instances every business date, which have costs settling four times day. ACH payments will likely be paid a comparable time, the following day otherwise inside 2 days to have fast processing. An enthusiastic ACH percentage try an electronic percentage created from you to lender to another. An employer that makes use of head put authorizes costs from the bank account to their team’ bank accounts via the ACH community.

Fruity Queen Local casino

Because the finance are set about how to access, you’ll comprehend the put shown on your offered balance. Mobile deposits are at the mercy of restrictions or other limitations. And you can connected banking companies, People FDIC and wholly had subsidiaries away from Bank out of The usa Company. Take control of your cash when, everywhere with the mobile application, today with Mobile Deposit. Aaron Broverman ‘s the head editor of Forbes Mentor Canada. He’s got more than a decade of expertise creating in the personal fund place to own retailers for example Creditcards.com, creditcardGenius.ca, Bing Finance Canada, Geek Purse Canada and you may Greedyrates.ca.

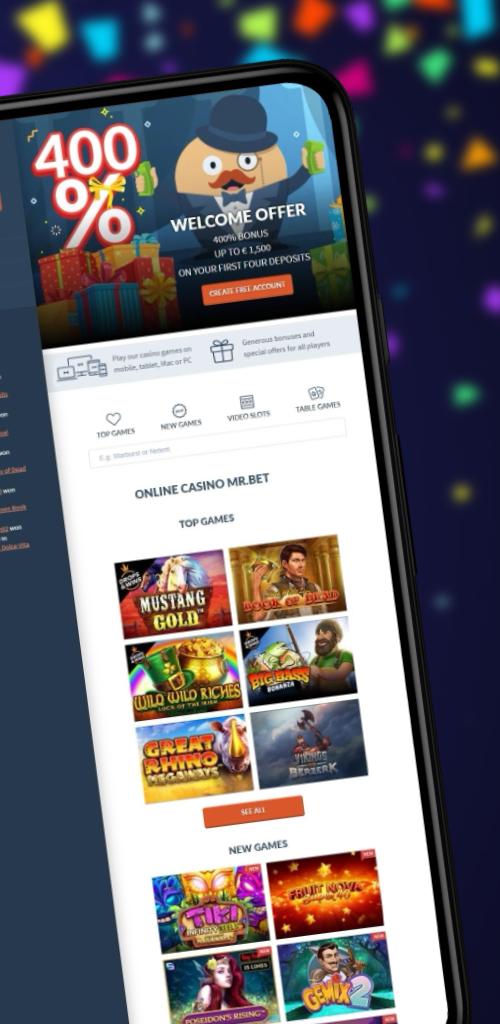

Talk about Much more Deposit Bonuses!

As this payment strategy gains prominence, you will need to learn its positives and negatives to be sure they aligns along with your gaming demands. As the level of people interacting with because of their phones for winning contests and you will activity is on the rise, the newest and you will smaller fee procedures are increasing. Once you’lso are capitalizing on the features away from cellular financial, you can access all the banking services you’re also accustomed—quicker, conveniently, and only while the securely. Financial has gone digital, but really some individuals still aren’t watching the benefits of cellular banking, along with using their financial’s cellular application.

Financial transfers will let you move currency right from the financial membership on the gambling enterprise membership. Most major Uk sites, for example Vodafone, O2, EE, and you will Around three, undertake shell out from the cellular telephone places, so it is simple for one to initiate seeing a favourite cellular local casino websites and you can game immediately. MrQ Casino is a highly-thought about spend-by-cellular telephone gambling establishment in britain.

To properly endorse a, flip they more and you will signal they using a black or bluish pen. Notate that it’s “to own cellular deposit only” myself using your signature, and check the brand new “mobile deposit” field if applicable. Financial deposit items, for example checking, savings and you will bank financing and you can associated characteristics are offered by JPMorgan Chase Bank, Letter.A great. Representative FDIC.

This can be even the easiest way to make use of the brand new pay by the mobile solution. You’ll establish the transaction thru an Text messages, and the count you transferred might possibly be added to their mobile phone expenses at the conclusion of the new week, that you’ll next pay as the regular. James first started employed in the internet gambling establishment industry inside Malta as the a good creator, prior to talking about gambling enterprises and you will esports gambling for brand new websites and you may associate businesses. Then he published local casino analysis to own Playing.com prior to joining Casinos.com full-some time might have been an element of the people since the. Whichever put approach you end up looking for, the process of funding your own local casino membership with real money tend to always be a comparable.

Most major banking companies offer this service to assist help save you go out and energy if you are however appointment all monetary requires. Only watch out for any potential limits before making mobile deposits. As the modern tools, banks tend to offer their clients multiple features built to create banking simpler. Of numerous banks render cellular banking, digital bag payments, peer-to-peer payments, and much more. Plus one common element—mobile take a look at put—lets users in order to put monitors from bank’s software without leaving home.

ET to your a corporate go out might possibly be available 24 hours later at no cost[3]. Spouse that have a major international commander who leaves debt requires basic. Invest oneself otherwise focus on a coach — we do have the items, technical and you may funding training, to construct your money. Morgan Riches Government Department otherwise below are a few our most recent on the internet paying also offers, promotions, and offers. Research any additional tips from the bank on the web or perhaps in the new application.

If your bank plans to lay a hold on tight the brand new deposit, you can even found a notification just before signing a mobile cheque deposit. You’d up coming have the option to continue for the cellular deposit and take the brand new cheque in order to a branch instead. Cheque with your lender to see the policy for holding dumps as well as how quickly the cellular cheque dumps is to obvious. Earnin is a popular fintech app built to give you very early usage of your paycheck instead of a leading-interest pay day loan. Other features are lower harmony notification plus the possibility to victory free dollars when you buy savings.

It also now offers a how-in order to movies that presents you the way to make use of the fresh mobile look at put element. ET to your a business date, your own money will likely be available from the second business day. ET otherwise to your a weekend or escape is processed another working day however they are not at all times readily available.

You need to know and therefore region of the take a look at is the front side, and you should remember that the brand new print for the front side try dependent to have discovering. Currently, the most popular pay because of the mobile phone costs approach inside Canada is Boku, with Payforit pursuing the closely about. Siru Cellular arrives on the top inside the countries for example Sweden and the United kingdom, to your team growing for the the fresh areas. Maintain the cheque until the money is put into your account which is seen in your account purchases just after cleaned. The brand new UKGC outlawed borrowing from the bank betting in the 2020, which could explain as to the reasons specific gambling enterprises features eliminated this process of the new cashier.

Endorsing a for cellular deposit can help end take a look at con — the financial institution is also browse the trademark from the take a look at guidance so you can make sure the newest payee is right. It also helps avoid the mistake out of placing a check twice. You’ve most likely seen a digital Wallet actually in operation, otherwise have the software on your cellular phone, but do you have the skills to use it? Digital Wallets render benefits by permitting you to definitely make use of your cell phone or other digital devices to cover anything as opposed to bucks or your plastic bank card.

For a cellular cheque deposit to be canned, it should be rightly endorsed. You’d must redeposit the brand new cheque, that may increase the prepared date up until it clears your own account. Deposit your own monitors using a cellular deposit software is safe, since the banking institutions use the large levels of security to protect their mobile put software, exactly as they do that have on the web financial.