QuickBooks Solopreneur (formerly known as QuickBooks Self-Employed) costs $20/month or $120 for the first year. This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports. Payment gateways allow you to accept payments from your customers. Common payment processing options include PayPal, Stripe, Square, and Authorize.Net. QuickBooks Online offers around 25 payment processors, or you can use QuickBooks Payments. QuickBooks Online payroll costs between $45-$125/month plus $6-$10/month per employee.

Pricing and features

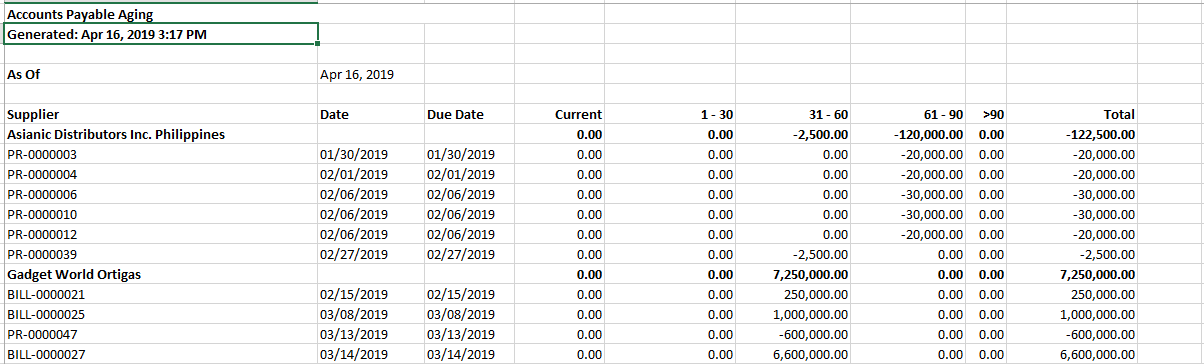

First, you can write and print checks directly from QuickBooks to pay for expenses that require immediate payment. Second, you will be able to enter and track bills and apply the payment of these bills correctly so that the expense is not recorded twice. Additionally, you’ll learn how to write what is the high-low method definition meaning example off bad debts, which are recorded as an expense in QuickBooks. QuickBooks Payments account subject to credit and application approval. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Is accounting software secure?

We are committed to providing you with an unbiased, thorough, and comprehensive evaluation to help you find the right accounting software for your business. We meticulously and objectively assess each software based on a fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study. However, the availability of support may vary depending on the specific issue and the type of QuickBooks Payroll subscription. QuickBooks, on the other hand, is a software dedicated only to accounting.

What Is the Opening Balance Equity Account in QuickBooks?

Our QuickBooks Online introduction can help, guiding you through some of the common features found in the software as well as providing easy, step-by-step instructions for using those features. Find help articles, video tutorials, and connect with other businesses in our online community. Plus allows you to assign classes and locations to your transactions, so you can see how your business performs across divisions, locations, rep areas, or any units that are relevant to your business. If you run businesses in multiple locations and you want to see which one is most profitable, an upgrade to Plus from Essentials is worth the price. The QuickBooks Online comparison chart below highlights some of the key features of the five versions. We include in-depth, side-by-side comparisons of each plan against its next-level tier in the sections that follow.

There’s plenty of information at your fingertips to help you make the most of your QuickBooks account, starting with these. If you play around with customization and decide you prefer the default setup, you can click “Reset to default menu” at any time to revert to QuickBooks’ built-in settings. For example, I’m not using payroll for my freelance business, so I can click the checkbox next to “Payroll” to remove it from my dashboard view entirely.

- You’ll be asked to confirm that the software has tagged each expense correctly.

- Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

- Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

- Here’s a look at all of QuickBooks’ small-business products, including accounting, point-of-sale and payroll software.

Small businesses that prefer locally installed software and work with a PC. He joined NerdWallet in 2019 as a student loans writer, serving as an authority on that topic after spending more than a decade at student loan guarantor American Student Assistance. In that role, Ryan co-authored the Student Loan Ranger blog in partnership with U.S.

We also evaluated whether an electronic bill pay integration was available. This section focuses more on first-time setup and software settings. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information. Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one.

Offers four plans to accommodate a range of businesses with different needs; each plan limits the number of users, though. This module covers how to manage your bills and record expenses in QuickBooks. As a small business owner or manager, you know that managing expenses is as important as generating sales. By the end of this QuickBooks lesson, you will be able to keep track of expenses in a couple of ways. Between the QuickBooks Online monthly fee and add-on costs, the monthly pricing of QuickBooks Online can add up quickly. Most integrations come with monthly subscription fees, so be sure to account for these extra costs when calculating your total costs for QBO.

You can download the QuickBooks Online mobile app from the Google Play Store or Apple App Store. If you’d like additional help, there are tutorials available on a wide range of accounting terms, skills and how-tos in our QuickBooks Tutorials section. If you want to use your software anywhere you have an internet connection, you’ll likely want to focus on QuickBooks Online or pay more to add remote access through hosting to QuickBooks Enterprise. Larger businesses with sophisticated inventory, reporting and accounting needs.

QuickBooks Online has over 750 integrations to choose from, including common software programs, such as Shopify, Gusto, and Mailchimp. The QuickBooks Online Simple plan costs $30/month and supports one user. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. In order to make your invoices stand out to your customers and get paid quicker, be sure to set up your invoice preferences prior to sending out your first invoice. Once you set up your bank connection, you can start categorizing all imported transactions. The nice part about this is that much of the transaction posting is completed automatically, making month-end reconciliation a breeze.

This will offer you a customized recommendation based on the responses you give. Afterward, continue reading our article for a more detailed comparison of the five QuickBooks Online plans. To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics. This hands-on approach helps us strengthen our accounting software expertise and https://www.business-accounting.net/hold-definition/ deliver on the Fit Small Business mission of providing the best answers to your small business questions. To manage payroll through QuickBooks Payroll, you’ll need to pay a fee for this add-on service, with plans ranging from $45 to $125 per month, plus an additional $5 to $10 per employee per month. Not all versions of QuickBooks offer multiple plans or make it simple to move your business from one product to another.

For example, with QuickBooks Online Plus and Advanced, you can track inventory and do job costing — that is, you can figure out how much you spent to complete a certain project. The main dashboard will give an overview of your QuickBooks account, showing your profit and loss overview, invoices, expenses and sales. We believe everyone should be able to make financial decisions with confidence. Our free QuickBooks tutorials will teach you the basics you need to know to start keeping the books for your small company or employer.

If you want to give QuickBooks a try before buying, you can sign up for a free 30-day trial or use the company’s interactive test drive that’s set up with a sample company. Hopefully, knowing the exact costs of QuickBooks Online will ease your mind and help you create a more realistic business budget. If you want to learn more about QuickBooks, read our complete QuickBooks Online review or get started with a free trial.

When signing up for QuickBooks Online, it only gives options for paying monthly. However, once you’ve signed up, navigate to your account settings, and you can switch to annual billing to save 10%. All Online plans include receipt capture, QuickBooks support and more than 650 app integrations with apps such as PayPal, Square and Shopify.

QuickBooks Simple Start is the easiest and quickest way for single users (freelancers, gig workers, solo entrepreneurs) to manage all of their income and expenses in one simple tool. With QuickBooks Simple Start, you can invoice customers, connect bank and credit card accounts, track sales https://www.personal-accounting.org/ tax, and run basic financial statements. You can also connect with your accountant, making it easier at tax time. QuickBooks Online — often considered the industry standard for accounting software — is fairly user-friendly, but some basic accounting knowledge will help you get started.